Last year was simply painful. All three major large-cap U.S. equity indices were in the red. The Dow Jones Industrial Average declined 8.8%, the S&P 500 fell 19.4%, and the tech-laden Nasdaq took a -33.1% nosedive.¹ Headlines note that this was the weakest calendar-year performance for all three benchmarks since 2008.² The international equity markets also swooned by double-digit figures, so there was nowhere to hide in stocks last year.

Putting the Data in Perspective

While it’s impossible to see anything positive in this data, we should put this in perspective for just a moment. Yes, these are the worst returns since 2008, but the S&P 500 took a punch roughly twice as hard that year in a deep recession, falling 37%, which is far more than this year.3 So not quite apples to apples. In addition, the -19.4% calendar-year return for the S&P 500 is depressing and frustrating, but at the end of the day, it doesn’t even meet the -20% minimum typically quoted as the threshold requirement for a technical bear market. We did experience a peak-to-trough intra-year decline of -25% in June of 2022, which does sync up with the 20% threshold of a bear. However, unlike past bear markets, we spent very little time in territory worse than -20% last year.4 Furthermore, the -19.4% didn’t come close to erasing the stellar 28% returns in 2021 and rather pales in comparison to the 26% annual compounded returns of 2019 to 2021.5 Please understand that I’m not saying, “Don’t worry, be happy.” I’m just saying that the market doesn’t go up in a straight line, and we need context as we reflect on what happened in 2022 to avoid making emotional versus fact-based decisions going forward and managing things well in 2023, which is our key mission as we move into the year.

A Look Back at Our 2022 Forecast

In our Crystal Ball webinar last year in January 2022, we suggested that investors should gear up for a significant correction of 15% to 20% in 2022. We recommended that if the unusually robust stock returns from 2019 to 2021 had taken their equity allocations to well above normal, they should rebalance back to their normal, long-term targets. We also urged folks not to “buy on the dips” like we did in past years during brief market pullbacks but to simply “hold your ground” out of respect for the many economic, policy-oriented and geopolitical transitions occurring during the year. We shared our belief that active management would likely add value versus a pure passive, index-only approach to investing. We are pleased with these strategic thoughts we embraced, but we certainly missed the thought that this correction would last as long as it has. We know this protracted correction tries investors’ patience. However, patience is important at this point in the economy and the market.

Where Is the Market Headed in 2023?

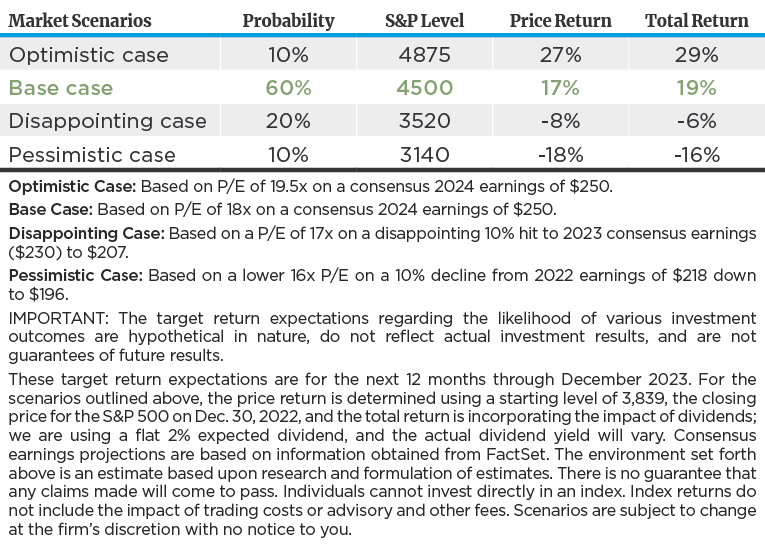

In terms of where we see things headed, the table below helps summarize our view. While we expect continued chop in the market and believe that at various points in 2023, we may temporarily hit any one of these four targeted levels ranging from pessimistic to optimistic scenarios, we embrace a base case level of 4,500 by the end of 2023 with potential upside to 4,875 when the year closes. It won’t come about without some angst and some drama, particularly in the early stages, but that’s our view. Hence, our continued message of “hold your ground.”

This year may well be the inverse of 2022, which was a year of continued economic growth and solid earnings results, yet a weak stock market. This year will likely be one with a weaker economy and disappointing earnings, yet it could be a year with decent stock market returns.

Strategies for Navigating 2023

Below are key thoughts and strategies we encourage investors to embrace/employ as we navigate the challenges and opportunities this year:

- “You Ain’t So Bad!” Just as Sylvester Stallone’s iconic character, Rocky Balboa, used to shout to his intimidating opponents in the series of “Rocky” movies over the years, we use this same phrase to describe today’s economy and financial markets. The Santa Claus rally may have faded in December from the promising attempt following midterm elections in November, but we believe it will eventually resume as 2023 evolves.

We look for an S&P 500 price level of 4,500 or higher sometime in the second half of next year. The market was volatile in the later stages of 2022, and recent data releases have been, too. On the one hand, there is good news, as exhibited in signs of calming inflation and hopes of an associated pause in tough talk and rhetoric from the Federal Reserve. However, this news seemed to be dashed quickly by fears of an economic slowdown and continued crabby comments from Fed Chair Jerome Powell.

Falling CPI numbers, which inspire price rallies, have quickly been followed by an economic report or two that suggest consumer demand is softening by a greater degree than expected or, ironically, that it is holding up too well, thus causing the Fed to threaten extended rate hikes and more pain. The rally fizzles and there you have it—the cycle repeats. Another “less-worse” CPI report, another rally. Another set of mixed economic data or Mr. Powell takes the podium and the rally fizzles. So the cycle goes. The week of Dec. 12, 2022, was a great example of this. The CPI numbers were better than expected as investors grabbed their popcorn and watched for the good results on Dec. 13, 2022. They cheered the news. Then they sold again when the Fed was less cheery about things in its Dec. 14, 2022, press conference and after a purchasing managers’ report that week showed consumers continued to reduce their appetite for manufactured goods. Right when folks were steeling themselves for more lumps of coal for Christmas on the heels of this data, a positive consumer confidence report was released on Dec. 21, 2022, and the market rocketed once again that day. Roller coaster trading and emotions out there. While this may not end immediately, we do think it is temporary.

We believe investors will finally exhibit sustained confidence after they see consistent declines in inflation and related signals from the Fed that indeed it can back off the rate hikes for a while and watch and see how its prior handiwork has impacted the economy. This should inspire some multiple expansion on earnings that are holding up surprisingly well. The fundamentals simply aren’t as ugly as the headlines make them feel.

While this is the most telegraphed recession by economists and as demonstrated by the price action in the S&P 500 itself (the 25% peak-to-trough decline in stocks in 2022 certainly reflects the S&P 500’s anticipation of one), it has yet to actually happen. If a recession does occur, it should be mild. A number of things are in place today, unlike during previous recessionary periods, that make us believe this assessment:

-

- The employment picture is much brighter than in earlier recessions. Not only is the unemployment rate quite low at present, but companies are loath to implement significant layoffs in the midst of tight labor market conditions. They are hanging on to workers in recognition of the elevated costs to recruit and train their workforce at this juncture.

- Consumer spending is very resilient given the excess savings created by historic stimulus doled out during the pandemic. Spending is shifting from buying goods to buying services and experience, but it is still there. Recent declines in gas prices serve as a timely “tax cut.”

- Consumer and corporate balance sheets are healthy, and debt service capability is far greater than in prior times of challenge.

- Inventories are more balanced heading into slowdown.

- Banks are in a better condition with home equity levels significant, unlike the underwater conditions seen in 2007/2008.

- The economy/earnings and the stock market are two separate animals. The former simply tell you where we are at a point in time, and because data is reported with a lag, it is a rearview mirror perspective. The stock market, on the other hand, is anticipatory in nature. It looks for where the economy and markets are headed, not where they have been. In this regard, the stock market already responded in 2022 as if a 2023 recession was a given. Hence, the negative returns last year. The bearish camp is worried that the next shoe to drop is confirmation we are in a recession and that corporate earnings will be revised down significantly. We, too, are cautious and believe the economy is likely slowing further and that we may see some additional negative earnings revision. However, we believe the market can still perform in solid fashion and recover from these levels in 2023, even if these events come to pass. It is important to note the following in this regard:

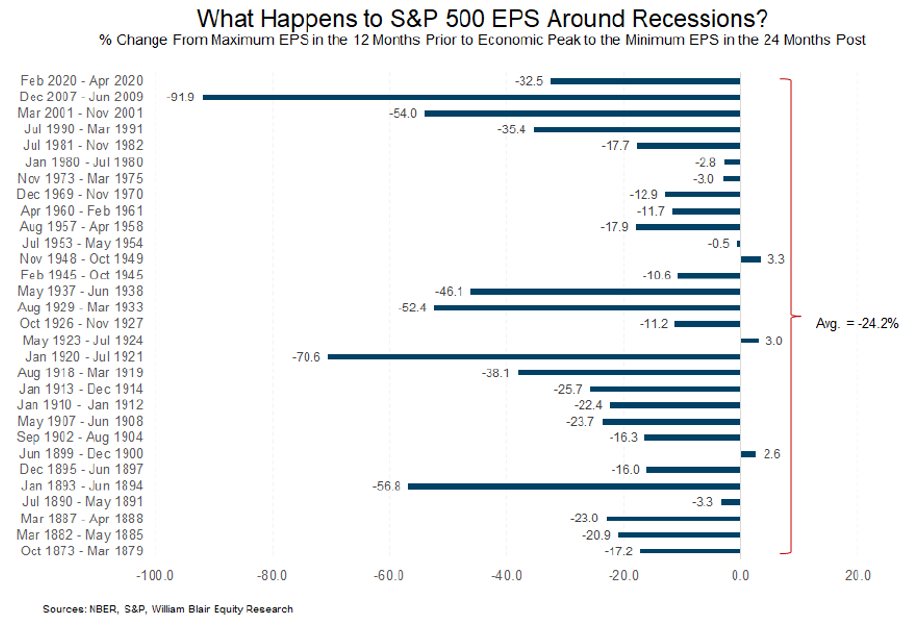

- There have been plenty of occasions in which corporate earnings have declined by low, single-digit levels or have even risen during recessions. We do think earnings declines, should they occur, will be quite modest versus the average 20% decline we see over all recession periods, for reasons I stated above.

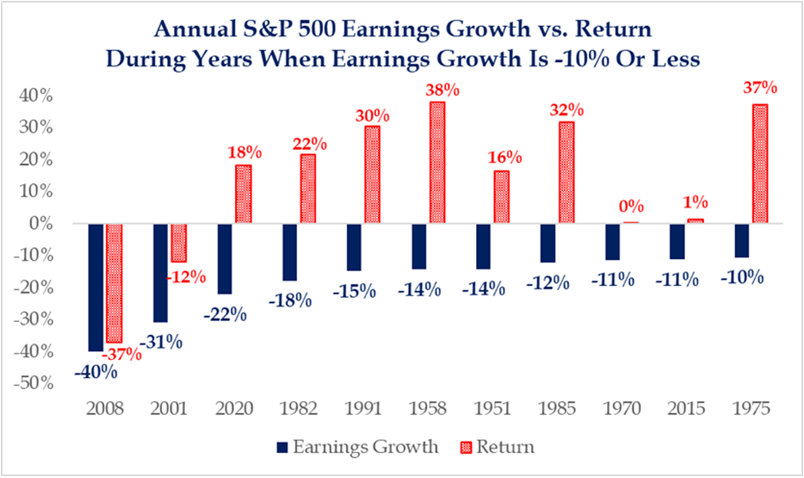

- There are a number of recessionary periods when earnings have declined by strong, double-digit levels, yet the S&P 500 advanced handsomely anyway. Why? Because stock prices are driven by three things: P/E levels, rates and inflation, and earnings. P/E levels and interest rates and inflation can overwhelm trends earnings because the market is forward-looking and anticipatory. If it believes inflation is calming and rates are stabilizing, P/Es can expand, and sentiment can improve in advance of a recovery in earnings. Check out the data on this if you don’t believe it.

Source: Strategas

- Almost half the time, stock market returns are positive during a recession as the pain in prices tends to occur in advance of it.

- The key is not for inflation to go back to where it was, it is simply important that it peaks and moderates. Again, check out the data on this. The bears think inflation must go back to where it was and that it is not good enough to decline yet remain elevated compared to the abnormally low rates in the early 2000s. We think calming to 3% is fine and quite frankly what should be expected. It is insane to believe in a period of deglobalization and concerns about climate change that we’ll see 2% inflation again for a while. But as a student of the stock market, I will note that of the six post-1950 periods of an inflation surge like we are seeing today, the market advanced 14% to 21% in the 12 months following a peak in the inflation metrics.6 The market did fine even if the inflation data remained relatively high. We don’t have to go back to where we were, and it’s probably not healthy to go back there anyway. We just need to be lower than where we are. On this front, the inflation data peaked in June and has been improving since then. Stay tuned.

- The Fed is no longer one voice. This is a good thing. When the Fed started hiking in 2022, it was a no-brainer to do so. All its members were in agreement. They proceeded full speed ahead in low-hanging fruit fashion to battle inflation. Now that we are multiple hikes into it, things are a bit nuanced. Some on the Fed believe they should slow down and pause soon. This camp also recognizes in a world in which you are re-onshoring supply chain from China to the U.S. and striving to build out electric vehicle production and alternative fuel capacity that inflation may run hotter than 2% for some time. Another camp in the Fed holds on blindly to the belief that 2% is the mandate and that we must adhere to that and go back there at all costs. Ironically, it was only a few months ago when Powell and the Fed said there are two mandates—full employment and stable prices. He said then that the former (employment) took precedence and that inflation may have to run hotter than 2% for some time to ensure we have ample and strong employment levels.

Interestingly, once pandemic supply chain issues, geopolitical conflict and other pandemic challenges drove inflation uncomfortably high, Powell switched gears. Not wanting to be viewed as the humbled Arthur Burns who failed miserably at the Fed in the hyper-inflationary 1970s, all of a sudden, he switched gears to becoming an inflation hawk in unanimous fashion with other Fed governors in 2022. We can’t help but believe he/they will shift once again to embracing inflation levels above where they were if unemployment spikes above levels they foresee at present. The dovish camp will grow quite vocal should this occur, particularly if a lot of good progress is already underway (like it is) in slowing the pace of price increases. Stay tuned, but Powell has exhibited that he covets his job and will likely reset and focus once again on healthy employment levels if inflation is on the mend and employment levels become challenged.

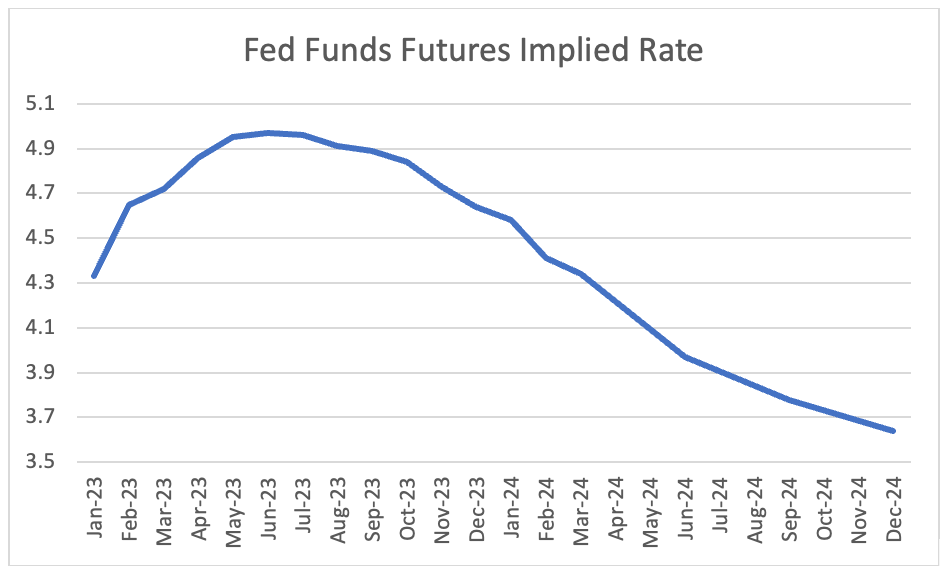

Other investors don’t believe the Fed’s hawkish rhetoric either. Fed funds futures see rate hikes ending in early/mid 2023 and Fed cuts in 2024.

Source: Fed Funds Futures Data Sourced from FactSet and is as of 12/30/2022.

What to Do as an Investor?

Our message continues to be “hold your ground.” As you know, we told clients/investors to brace for a 15% to 20% correction in January of 2022 as a result of the transition in the economy, geopolitically and in regard to monetary and fiscal policies on the world stage. We suggested that if one’s equity allocation had risen to well above normal levels because of the robust 26% annualized compounded returns in the prior three-year period, they should rebalance and cut back to their long-term normal level. We also cautioned not to buy on dips like we suggested in prior years. We are still there. That said, we think the bottom may have been set back in October, or close to it. We could retest and believe that we continue this rally/fizzle cycle for a bit on day-to-day news flow with a still-fragile investor mindset out there, but we do believe that clear evidence of continued improvement in battling inflation will take us higher and perhaps to higher highs in a reasonable period. In the interim, as we see some additional churn in the early goings of 2023, we recommend/observe the following:

- Practice Patience—Don’t sell, but don’t buy aggressively either. If dollar-cost averaging into the market, continue to do so at a normal, not accelerated, pace.

- Be Balanced—Own growth and value and offense and defense. High-quality, “long duration” assets are not dead! They are critical for efficiency and to drive labor productivity in an elevated inflation environment.

- Don’t Predict the Predictors—Don’t tell key market indicators what they should be doing. Listen and watch and see how they are trending and let that guide decisions. Remember, data does not need to be beautiful in an absolute sense. It just needs to trend better. Going from horrible to terrible to only bad is getting better! Check out 2009. The economy was still losing jobs and earnings were almost cut in half… yet the market advanced 30%. Why? Things were getting “less worse.” Bonds look better as an investment, and small caps may be an opportunity in 2023.

We will provide more details in our Jan. 19, 2023, Crystal Ball Outlook webinar. More to come on that front, so stay tuned.

In the interim, we thank you for your confidence and the opportunity to serve you. We wish you the best for a prosperous and healthy 2023!

Footnotes:

1-5 FactSet

6 Strategas

Definitions

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation.

The Dow Jones Industrial Average(DJIA) is an index that tracks 30 large, publicly owned companies trading on the New York Stock Exchange (NYSE) and the NASDAQ.

The Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange.

Disclosures

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

Rebalancing is an investment strategy that can help manage risk within your portfolio, but it does not guarantee profits or protect against loss in declining markets. Keep in mind that rebalancing may have tax consequences and transaction costs associated with it.

Fixed-income securities are subject to increased loss of principal during periods of rising interest rates and are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors.

Small-cap stocks are generally subject to greater price fluctuations, limited liquidity, and higher investment risk than larger, more established companies.

This is provided for informational and educational purposes only and does not consider any individual personal, financial, legal, or tax considerations. The information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources deemed to be reliable, but we do not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Consult your financial professional before making any investment decision.

Investment advisory services are provided through Mariner Platform Solutions, LLC (“MPS”). MPS is an investment adviser registered with the SEC, headquartered in Overland Park, Kansas. Registration of an investment advisor does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MPS transacts business and maintains clients. MPS is either notice filed or qualifies for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by, or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information.